Based on recent headlines, the stock market and economy appear poised for more volatility through the end of the year and most of 2024. You’re not alone if you’re concerned about a potential recession in 2024, persistent inflation, and rising interest rates. You need unique financial solutions to protect what you have worked so hard to build.

One way to safeguard your retirement savings during turbulent market conditions is by engaging the services of a Utah CERTIFIED FINANCIAL PLANNER™, also referred to as a CFP®.

At Scott Marsh Financial, our team has been using behavioral finance methodologies to assist successful individuals and their families in safeguarding their retirement assets during turbulent times.

This blog will share some of our insights on how behavioral finance may help you pursue your goals and protect your family’s multi-generational legacy.

A Look at Behavioral Finance

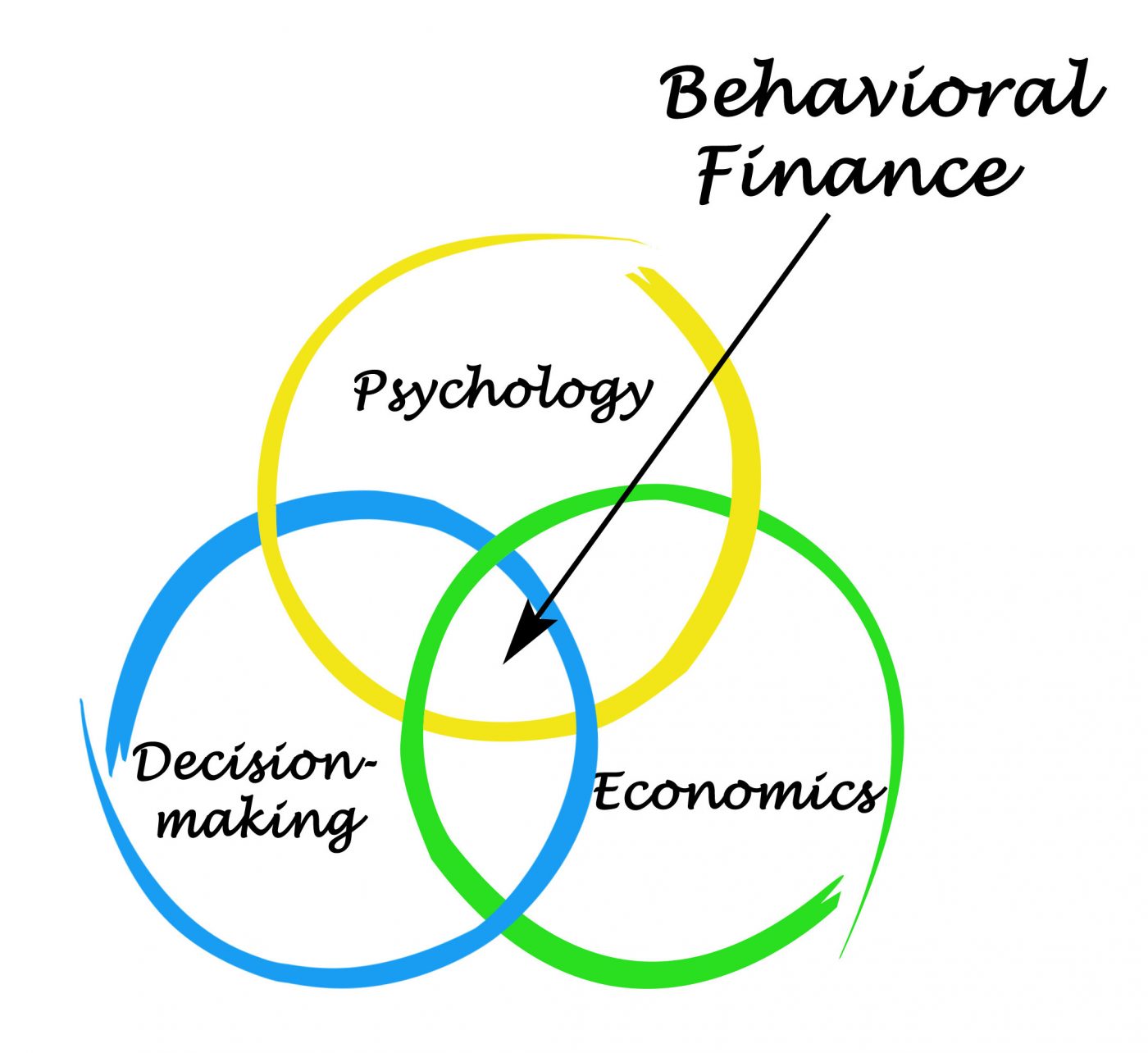

In a nutshell, behavioral finance explores the psychology and emotions that influence our financial decision-making. This process can reveal why we sometimes need more rational choices for investing our money. Then, it examines how those feelings and emotions impact the bigger picture -how you make the right planning and investment decisions.

Behavioral finance concepts also play an even bigger role in your retirement planning decisions, especially in the face of economic uncertainties that can increase the volatility of the securities markets. While these factors may create anxiety and uncertainty, understanding behavioral finance principles can help you make rational financial decisions and avoid irrational decisions.

Risk Tolerance and Emotional Resilience

Behavioral finance teaches us the importance of assessing our capacity for taking risk tolerance more accurately. There can be a big difference between our risk tolerance (emotion-backed) and our capacity to take risks (financial impact). For example, during economic turbulence, it’s important to understand how market volatility impacts you emotionally and, in turn, your financial decision-making.

This involves a rational assessment of your comfort level when your assets are experiencing unrealized losses. How do you react, and how does your reaction impact your lifestyle and financial security later in life? For example, are you willing to stay invested during prolonged down markets because you are young enough to recover the losses before you need the assets or income from the assets?

The Rationale for Goals-Based Investing

Instead of getting caught up in the noise of market predictions and election outcomes, focus on your long-term financial goals. Start by working with a CERTIFIED FINANCIAL PLANNER™ to develop a personalized retirement plan that addresses your needs, goals, and timelines.

Behavioral finance focuses on goal-based investing, which means your current investment decisions should be based on your long-term objectives. No one has a crystal ball that can predict short-term market movement with any degree of accuracy.

Diversification and Asset Allocation

Understanding your emotions and biases—such as aggressive investing, loss aversion, or herd mentality—can be instrumental in developing asset allocation strategies that align with your risk tolerance and long-term objectives. That is, how much do you invest in the stock market, bond market, and other investments that have their levels of risk?

By recognizing your personal behavioral traits, you can create an investment strategy that avoids emotional pitfalls that undermine the achievement of your financial goals.

This self-awareness enables you to make better decisions that expand your wealth with a comfortable level of risk in various market conditions.

- You should allocate your investments across asset classes such as stocks, bonds, real estate, and alternative investments. Ideally, these investments are non-correlated; that is, they do not move in the same direction based on the same economic events. For example, higher inflation can hurt the performance of stocks and help the performance of income-producing real estate.

- Invest in several global. All of the best investments are not headquartered in the U.S. Geographical diversification can improve results and minimize risk.

- Spread your investments across various sectors of the economy, such as technology, healthcare, finance, and consumer goods. This strategy ensures that your portfolio isn’t overly dependent on the performance of one industry.

- Match your investment choices with your financial goals and time horizons. Long horizons can handle more risk because you have more time to recover unrealized losses. On the other hand, a strategy for a short horizon should be more risk-averse because you will have less time until you need the assets.

- Understand your risk tolerance and invest accordingly. If significant unrealized losses will keep you awake at night, you should focus on more conservative investments. If you understand volatility is part of the process, you may be better off with a more aggressive strategy.

- In case of a job loss or other financial setback, it is important to have a plan that covers your living expenses during unemployment – a minimum of six months is appropriate.

The Benefits of Working with a Utah CFP®

Working with a CERTIFIED FINANCIAL PLANNER™ (CFP®) integrates behavioral finance into your retirement planning and can offer numerous advantages, especially during economic turbulence.

Here’s how a CPF® can help you:

A CFP® well-versed in behavioral finance understands that emotions and biases can impact your financial decisions. The CFP® can help you deal with the emotional rollercoaster caused by economic fluctuations. This personalized approach can help you avoid emotion-backed decisions that can harm the pursuit of your long-term financial goals.

A CFP® can tailor your retirement plan to your needs, goals, and risk tolerance. This professional will consider all the variables that impact your financial future and then build a plan just for you. This personalized plan can be your source of financial security during uncertain times.

Another benefit of working with a CFP® is their ability to keep you focused on your long-term financial goals. They will encourage you to avoid rash decisions based on short-term market fluctuations or political events. This disciplined approach can lead to better financial outcomes over time.

When it comes to your money, you should never take a “set-it-and-forget-it” mentality. A proactive CFP® should continuously monitor your financial situation and adjust your retirement plan as needed. This dynamic approach ensures that your plan remains aligned with your goals and responsive to changing economic and market conditions.

Get to Know the Scott Marsh Financial Team

You’ve probably heard enough that your financial decisions may be driven more by emotions than disciplined logic. That’s where behavioral finance comes in. At Scott Marsh Financial, we’re big believers in behavioral finance because it’s grounded in history and numbers, not emotions.

This means we can highlight financial habits that help you pursue your goals and the destructive emotions that undermine the achievement of your goals.

Our background in higher education also gives us a unique way of breaking down these behavioral finance principles. Our goal is to make the consequences of your financial decisions easy to understand. We want to help you make the right decisions for the right reasons.

We’re not just another financial advisory firm. We offer comprehensive, family office-level services, ensuring every aspect of your financial life is being considered and planned for. This includes planning, investing, tax, risk management, and legal. Then, we overlay these services with the principles of advanced behavioral finance.

Want to learn more? Contact us to schedule an introductory meeting.